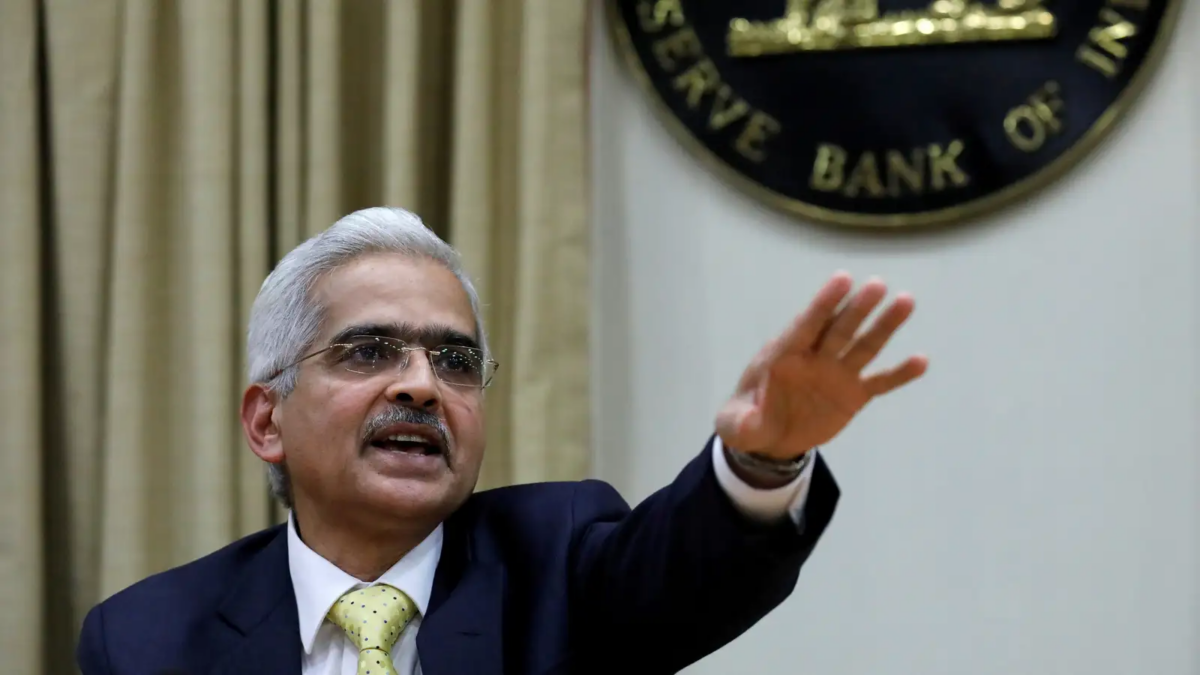

Governor Shaktikanta Das of the Reserve Bank of India (RBI) stated on Thursday that the MPC (Monetary Policy Committee) of the RBI had agreed to maintain the expected lines of policy by maintaining the key interest rate and stance. Additionally, Das’s MPC maintains the monetary policy’s “withdrawal of accommodation” approach. Das made the announcement of the policy decision, saying, “MPC judged that it is important for monetary policy to stay the course while maintaining close vigil on risks.”

In a 4:2 vote, the Committee—which is composed of three RBI members and three outside members—decided to keep the repo rate at 6.50 percent for the ninth consecutive meeting, which took place from August 5–7.

According to the RBI, Dr. Ashima Goyal and Prof. Jayanth R. Varma voted to lower the policy repo rate by 25 basis points, while the remaining four committee members supported maintaining the status quo.

Inflation will be in focus once again and Das said that high food price are likely to have continued impact in July as well. He further noted that food inflation has weight of 46 percent cent on headline inflation and that it cannot be ‘ignored’. The governor cannot and should not become complacent because core inflation has fallen considerably. India’s CPI in June stood at 5.1 per cent on the back of surge in vegetable prices. The CPI accelerated for the first time in five months, data showed in July.

Key Highlights of August RBI MPC Meet

MPC voted to keep repo rate unchanged at 6.50 per cent. standing deposit facility (SDF) rate remains unchanged at 6.25 percent, as do the marginal standing facility (MSF) rate and the Bank Rate at 6.75 per cent.

The MPC also decided to continue withdrawing of accommodation stance.

Das said that the MPC has decided to focus on inflation and support price stability to ensure growth.

The real GDP forecast for FY25 was kept unchanged at 7.2% with Q1 slightly reduced to 7.2 per cent; Q2 at 7.2 per cent; Q3 at 7.3 per cent; and Q4 at 7.2 per cent

The real GDP for Q1FY26 is also projected at 7.2 per cent

Das said that the moderation in Q1FY25 growth forecast is due to updated information on certain high frequency indicators.

The RBI MPC projected inflation forecast for FY25 unchanged at 4.5 per cent, while it stands at 4.4 per cent for FY26.

Inflation for Q2 has been hiked to 4.4 per cent from 3.8 per cent; Q3 projection raised to 4.7 per cent from 4.6 per cent and finally Q4 projection eased to 4.3 per cent from 4.5 per cent.

MPC stays resolute in its commitment to aligning inflation to the 4 per cent target on a durable basis, RBI Guv said.

India’s current account deficit (CAD) moderated to 0.7 per cent of GDP in 2023-24 from 2.0 per cent of GDP in 2022-23 due to a lower trade deficit and robust servicesand remittances receipts.

A degree of relief is expected due to healthy kharif sowing and picking up southwest monsoon, Das noted.

The RBI Governor also laid emphasis on the need to ‘carefully monitor’ mobile tariffs and milk prices.

The apex bank will continue to be nimble and flexible in liquidity management operations, says Shaktikanta Das.

RBI Governor Shaktikanta Das also expressed concern over rising disbursals of top-up home loans and has asked lenders to take remedial action.

India’s forex reserves reached a new high of $675 billion as of August 2.

The RBI expressed its concerns regarding the third-party outsourcing of technological requirements for banks and financial institutions in light of the global Microsoft outage that happened last month.

The governor pressed for stakeholders in the fintech sector to work towards eliminating any possibility of cyber outages in the future.

A focus on mobilizing household savings through innovative products is recommended

Despite moderated credit growth in some sectors, personal loans are still growing rapidly, necessitating careful monitoring of leverage and reassessment of underwriting standards.

RBI Guv noted that rapid growth in home equity and top-up loans, especially on collateralized loans, with some entities not adhering to regulatory guidelines, could lead to unproductive or speculative fund use. The RBI has advised a review and necessary corrective actions.

Key announcements

The RBI has proposed to create a public repository of digital lending apps to help prevent unauthorised lenders.

UPI tax payment limit has been hiked from Rs 1 lakh to Rs 5 lakh per transaction.

It has also been proposed to introduce continuous check clearing. Steps to speed up the clearance of checks to a few hours will be taken, Das said.

RBI has decided to increase the frequency of credit information reporting by credit institutions (CIs) to credit information companies (CICs) from a monthly basis to a fortnightly basis or at such shorter intervals as agreed upon.

RBI proposed to introduce “Delegated Payments” in UPI, which would allow an individual to set a UPI transaction limit for another individual (secondary user) on the primary user’s bank account