The Securities and Exchange Board of India (Sebi) is scheduled to hold a crucial board meeting on Monday, marking the first gathering since chairperson Madhabi Puri Buch faced allegations of conflict of interest. These accusations were raised by US-based Hindenburg Research and India’s Congress party. While the conflict of interest allegations and issues related to a withdrawn press release on employee matters are not officially on the meeting’s agenda, they may be informally discussed, according to insiders. One source noted that significant events involving the institution or its board members since the last meeting on June 27 must be addressed.

Between the last board meeting and the upcoming one on September 30, Sebi employees had complained to the finance ministry about what they described as a “toxic work culture.” Initially, Sebi attributed the unrest among employees to external forces but retracted this statement after staff protests.

During this period, Hindenburg Research accused Buch and her husband of having investments in offshore funds controlled by Vinod Adani, brother of Adani Group chairman Gautam Adani. These funds were allegedly used for stock manipulation within the Adani Group’s listed entities. It was also alleged that Sebi had modified rules related to real estate investment trusts (REITs) in a way that favored Blackstone, where Buch’s husband served as a senior advisor.

The Congress party further accused Buch of trading in listed securities, including selling employee stock options from her previous employer, ICICI Bank, during her tenure at Sebi. They also claimed she earned money through her advisory firm, which offered consultancy services to listed companies, thereby violating Sebi’s conflict of interest policy.

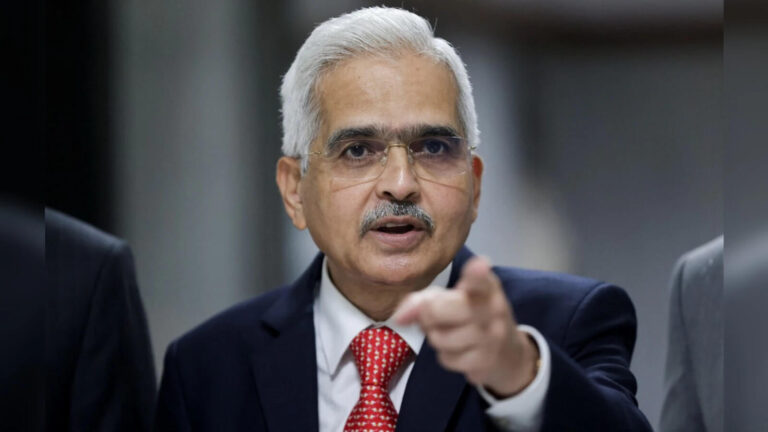

Both Buch and Sebi have denied these allegations, but the board has yet to express its stance. The board includes eight members: Buch, four whole-time members from Sebi, and three part-time nominees from the finance ministry, corporate affairs ministry, and the Reserve Bank of India.

This meeting will be the first for Deepti Gaur Mukerjee, the new corporate affairs secretary, and the last for M Rajeshwar Rao, the deputy RBI governor, who retires next month. External members may press for a discussion on the allegations against Buch, though it is uncertain whether these discussions would be formally recorded. The outcome of this meeting could shape Buch’s future as Sebi’s chairperson.

The board is also expected to address several proposals, including relaxing norms for rights issuances, introducing a new asset class, and implementing “mutual fund-lite” regulations for passive funds. The new asset class is intended to fill the gap between mutual funds and portfolio management services, allowing investments between ₹10 lakh and ₹50 lakh. Sebi is also considering tightening futures and options (F&O) trading rules, although this proposal may not require board approval, as it does not involve amendments to existing regulations like the SECC or the Securities Contract Regulation Act. Sebi has not responded to inquiries regarding Monday’s board meeting.